What are layoffs. Calculation of payment of funds upon dismissal of one's own free will

Severance pay is a monetary compensation paid to an employee on the last working day, determined by the Labor Code of the Russian Federation or the terms of a collective agreement. The amount of the benefit is not specifically indicated, it depends on the grounds for dismissal of the employee. Naturally, in addition to the severance pay, the resigning employee must be paid wages and compensation for vacation days that he did not take off. But that's a completely different story.

Grounds for dismissal and the amount of accrued severance pay

If the reason for the dismissal of an employee is the termination of the employment contract associated with a reduction in staff or the liquidation of an organization, then he must be paid the average salary for two months (for the first month it is mandatory, for the second if the employee cannot find a job at that time). If an employee applies within two weeks after his dismissal to the employment service and they cannot find him a job there for the next month and a half, then he will be paid the average earnings for another month.

The payment of a severance pay to an employee in the amount of two weeks' earnings is provided for in cases where he is dismissed for the following reasons:

The employee does not correspond to the position held or the work performed for health reasons;

Calling up an employee to serve in the army or to an alternative service that replaces it;

If the employee refused the transfer associated with the relocation of the employer to another region.

All these grounds are spelled out in the relevant paragraphs of the articles of the Labor Code of the Russian Federation.

The legislation provides for the payment of a severance pay to an employee in the amount of his monthly earnings in the event that the termination of the employment contract occurred due to violation of the rules for its conclusion. But only in cases where such violations do not allow the employee to perform labor duties, and it is not his fault to allow such violations.

An employment or collective agreement provides for other cases for the appointment and payment of severance pay, and also allows for the establishment of their increased amounts.

Severance pay for certain categories of employees

Separate rules and procedures for the payment of severance pay have been established for certain categories of employees. Thus, a civil servant must be paid the average earnings for the last three months for his position in cases where the dismissal is associated with the liquidation of the state body where he served or a reduction in staff. This does not include severance pay. Moreover, if a civil servant could not be provided with a job corresponding to his profession and qualifications, then he will be listed in the reserve of the register of civil servants, and the civil service experience will be considered continuous for one year.

It should be added that collective agreements can only improve the legal position of an employee, but not worsen it in any way in relation to the provisions provided for in the Labor Code and other regulations governing labor legislation.

This means that the Labor Code of the Russian Federation and other legislative acts regulating a specific area of work activity establish the minimum allowable amount of severance pay. And the maximum amount of the benefit is determined by the collective agreement or a separate agreement.

In conclusion, it should be noted that a severance pay equal to three months of average earnings is not subject to personal income tax. If the amount of payment exceeded this value, then income tax is charged on the amount exceeding the established limit.

For the category of workers performing labor duties in the regions of the Far North and equated to them, the non-taxable limit has been doubled and amounts to six average monthly salaries.

Severance pay upon dismissal - grounds for payments

In what cases is severance pay paid upon dismissal? An allowance in the amount of average earnings (per month) is paid to a dismissed employee upon termination of the contract due to a reduction in the staff of the organization or in connection with the liquidation of this organization. At the same time, the employee retains the average salary for the period of employment (the term is no more than two months, starting from the day of dismissal).

A severance pay, the amount of which is equal to earnings for two weeks, is paid to the employee upon termination of the contract under such conditions as:

Refusal of an employee to transfer to another job.

Call for military service.

On-site reinstatement of an employee who previously performed this work.

Recognition of disability.

Refusal of an employee to continue work.

Severance pay during reduction - what does the Labor Code say?

The Labor Code of the Russian Federation guarantees each employee a severance pay in case of staff reduction. That is, the employer has no right to "get out" of benefits. Upon dismissal for this specific reason, and not, for example, by agreement of the parties, the employee has every right to demand payment, and the employer is obliged to pay benefits.

Paid severance pay for redundancy in the amount equal to the average earnings. As for the second severance pay, it can be received for the second month if the employee is not employed.

An employee who is engaged in seasonal work must receive a severance pay of the Labor Code of the Russian Federation in an amount equal to earnings for two weeks.

An employee with whom an agreement has been concluded for a period of up to 2 months does not receive severance pay, unless otherwise provided by the agreement.

Calculation of severance pay upon dismissal or reduction

Upon dismissal (reduction), the calculation of severance pay is carried out according to a certain formula:

The average earnings for one working day are multiplied by the number of working days that are included in the benefit calculation period. As for the average daily earnings, it is calculated not for a calendar, but for a working day. The number of working days is calculated according to the production calendar (the more days off, the less the benefit will be). Taxes are not deductible from this type of benefit.

The average earnings are calculated as follows: the salary for the year before the month in which the dismissal occurred (and excluding sick leave / vacation, etc.) is divided by the number of working days for this period, according to the production calendar.

Severance pay - how not to be deceived?

Employers pay severance pay with great reluctance. Many organizations even ask their employees to write a statement confirming the dismissal of their own free will, so as not to pay benefits. It is worth remembering that you are not required to write such a statement. You should also be aware that:

Upon dismissal, the severance pay is not subject to personal income tax (not a single type of compensation payment), in accordance with paragraph 3 of article 217 of the Tax Code of the Russian Federation.

If the employee agrees to dismissal for reduction before the expiration of the period specified in the notice of reduction, he is entitled to additional compensation. Its size is equal to the average salary, calculated according to the time remaining until the expiration of the employee's direct notice of dismissal. At the same time, the right to receive average earnings for the period of employment and to receive severance pay remains with him.

Do you have any questions? Just call us:Sometimes employers are required to pay the employee upon dismissal not only the salary for the time worked in the month of dismissal and compensation for unused vacation, but also other amounts.

It is with their calculation and payment procedure that difficulties often arise, since the Labor Code of the Russian Federation does not determine the exact procedure for either their calculation or their payment.

And if you do something wrong, there may be claims from the employee and the labor inspectorate if he complains there. Claims from inspectors cannot be avoided if an incorrect calculation of these payments leads to an underestimation of the taxable base for income tax, personal income tax and contributions.

What payments and when are due to the employee

Upon dismissal for some reason, the obligation to make payments and their amount depend on who is the employer - an organization or an entrepreneur.

TELLING THE EMPLOYEE

The employment agency will issue decision to receive earnings from the former employer for the third month employment, if within 2 weeks after the dismissal the employee applies to this body and he is not Art. 178 Labor Code of the Russian Federation.

If the employer dismisses employees due to the termination of activities and p. 1 h. 1 art. 81 of the Labor Code of the Russian Federation or downsizing or downsizing p. 2 h. 1 art. 81 of the Labor Code of the Russian Federation, then the severance pay and earnings for the period of employment of the dismissed employees are paid in the amount stipulated by the employment contract m Art. 307 of the Labor Code of the Russian Federation. If nothing is written in the contract with the employee, then nothing is paid at all. Cassation ruling of the Kirov Regional Court of 09/06/2011 No. 33-3185; Cassation ruling of the Khabarovsk Regional Court dated July 9, 2010 No. 33-4591; Determination of the Moscow Regional Court dated May 27, 2010 No. 33-8604.

Payments to employees upon dismissal for other reasons are the same for organizations and entrepreneurs.

severance pay

The Labor Code obliges to pay severance pay only upon dismissal for the following reasons.

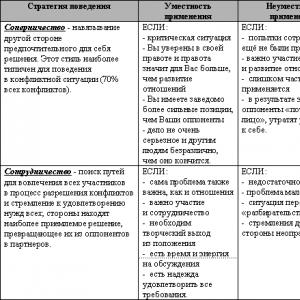

| Grounds for dismissal | Severance pay |

| Liquidation of an organization p. 1 h. 1 art. 81 of the Labor Code of the Russian Federation | Average monthly earnings for all employees except m Art. 178 Labor Code of the Russian Federation:

|

| Reducing the number or staff of employees of the organization p. 2 h. 1 art. 81 of the Labor Code of the Russian Federation | |

| Refusal of an employee to transfer to another job for medical reasons p. 8 h. 1 art. 77 Labor Code of the Russian Federation | Biweekly average earnings Art. 178 Labor Code of the Russian Federation |

| Conscription for military service (recruitment for alternative service) p. 1 h. 1 art. 83 of the Labor Code of the Russian Federation | |

| Reinstatement at work by a court decision or labor inspection of an employee who previously performed this work for p. 2 h. 1 art. 83 of the Labor Code of the Russian Federation | |

| Refusal of an employee to transfer to work in another locality together with the employer p. 9 h. 1 art. 77 Labor Code of the Russian Federation | |

| Recognition of an employee as completely incapable of work in accordance with a medical report m p. 5 h. 1 art. 83 of the Labor Code of the Russian Federation | |

| Refusal of the employee to continue work in connection with a change in the terms of the employment contract for reasons related to changes in organizational or technological working conditions p. 7 h. 1 art. 77 Labor Code of the Russian Federation | |

| Violation through no fault of the employee of the rules established by law for concluding an employment contract, if this excludes the possibility of continuing his work and there is no possibility of transferring him to another job p. 11 h. 1 art. 77 Labor Code of the Russian Federation* | Average monthly earnings Art. 84 of the Labor Code of the Russian Federation |

* Such violations include cases of concluding an employment contract with persons and Art. 84 of the Labor Code of the Russian Federation:

- who are deprived by a court sentence of the right to hold certain positions or engage in certain activities;

- for whom, for medical reasons, a specific job is contraindicated;

- who do not have a document on education, and according to the legislation, the performance of work requires special knowledge;

- who are disqualified, deprived of a special right or expelled from the Russian Federation;

- who are dismissed from the state or municipal service, if restrictions on their involvement in labor activity are established by law;

- who are prohibited by law from engaging in certain types of labor activity (for example, minors cannot be hired for hazardous work at Art. 265 of the Labor Code of the Russian Federation).

Severance pay is a payment for the very fact of dismissal. Therefore, it must be paid to the employee on the day of dismissal. Part 4 Art. 84.1, art. 140 of the Labor Code of the Russian Federation. The basis for its payment is an order that indicates the appropriate reason for dismissal. There is no need to issue a separate order for the payment of benefits.

Earnings for the period of employment

This payment is due only to employees dismissed from organizations on two bases Art. 178 Labor Code of the Russian Federation:

- in case of liquidation of the organization;

- in the event of a reduction in the number or staff of employees.

| Category of workers | For what period is the average monthly salary paid? |

| Seasonal workers | Not paid |

| Employees hired for up to 2 months | Not paid |

| part-timers | Not paid |

| Persons working in the regions of the Far North and equivalent areas | Until the moment of employment, but no more than 6 months after the dismissal, I Art. 318 of the Labor Code of the Russian Federation |

| Other workers | Until the moment of employment, but no more than 3 months after the dismissal, I Art. 178 Labor Code of the Russian Federation |

After the first month after the dismissal, the former employee nothing is paid because severance pay has already been paid on the day of dismissal articles 178, 318 of the Labor Code of the Russian Federation.

Earnings for the period of employment should provide the laid-off workers with financial support after the dismissal, provided that they did not immediately find another job. Therefore, it is paid only after the employee confirms that he has not yet settled in a new job.

Sometimes an employee (especially during the liquidation of an organization) is paid earnings for the period of employment immediately on the day of dismissal, without waiting for confirmation that the employee has not found a job. Such a payment is not economically justified, since the employer does not have evidence confirming its validity. Art. 252 Tax Code of the Russian Federation.

What documents must be required from a former employee to pay earnings for the period of employment depends on the month for which he is paid after dismissal.

| Period | The amount of the payment and the documents on the basis of which it is paid articles 178, 318 of the Labor Code of the Russian Federation |

| After the second month after dismissal for ordinary employees | Average monthly income

|

| After the second and third months after the dismissal for persons working in the regions of the Far North and equivalent areas | |

| After the third month after dismissal for ordinary employees | Average monthly income* if the former employee presents:

|

| After the fourth, fifth and sixth months after dismissal for persons working in the regions of the Far North and equivalent areas |

* If the former employee gets a job before the expiration of the second or subsequent months after the dismissal, then the average monthly salary must be paid to him in proportion to the "unemployed" period on the basis of a written application and a copy of the work book certified at the new place of work articles 178, 318 of the Labor Code of the Russian Federation.

** A copy must be made of it, certified and stored.

An employee can apply for this payment at any time, even a year after the dismissal.

Early termination compensation

TELLING THE EMPLOYEE

If organization located in the process of liquidation but also not excluded from the Unified State Register of Legal Entities, For earnings retained for the period of employment, the employee must apply to the liquidation commission as soon as possible. Indeed, after the exclusion of the organization from the Unified State Register of Legal Entities, it will no longer be possible to receive this payment.

In case of liquidation of the organization or reduction of its number or staff, the employer is obliged to notify employees in writing of the upcoming dismissal at least 2 months in advance and Part 2 Art. 180 of the Labor Code of the Russian Federation. At the same time, with the consent of the employee, the employment contract with him can be terminated before the expiration of the notice of dismissal with the payment of additional compensation, in addition to the severance pay and average earnings retained by the employee for the period of employment.

The amount of additional compensation is determined based on the average monthly salary of the employee, in proportion to the time remaining before the expiration of the warning period. Part 3 Art. 180 of the Labor Code of the Russian Federation. For the organization, the payment of such additional compensation is not entirely beneficial, because the employee will receive it not for work, but for agreeing to early dismissal.

Compensation for top managers

The Labor Code provides for special compensation upon dismissal and Art. 181, paragraph 2 of Art. 278, art. 279 of the Labor Code of the Russian Federation:

- in connection with the change of the owner of the property of the organization - for its head, his deputies and the chief accountant.

Change of ownership of the organization's property - these are, in particular:

- privatization of state or municipal property a Art. 1 of the Law of December 21, 2001 No. 178-FZ;

- transfer to state ownership of property owned by an organization paragraph 2 of Art. 235 of the Civil Code of the Russian Federation;

- sale of the enterprise as a property complex articles 559-566 of the Civil Code of the Russian Federation.

There is no change in the ownership of the property of the organization when changing the composition of participants in an LLC or JSC paragraph 1 of Art. 66, paragraph 3 of Art. 213 of the Civil Code of the Russian Federation; paragraph 32 of the Resolution of the Plenum of the Supreme Court of March 17, 2004 No. 2;

- without explaining the reasons - for the head of the organization in the absence of guilty actions on his part.

Compensation to top managers must be paid on the day of dismissal in the amount of at least three monthly earnings in Art. 181, paragraph 2 of Art. 278, art. 279 of the Labor Code of the Russian Federation. Severance pay and average monthly earnings for the period of employment in these cases are not paid to top managers.

Other payments upon dismissal

An employment or collective agreement may provide for payments to a dismissed employee on other grounds, as well as increased payments upon dismissal in the cases established by the Labor Code of the Russian Federation x articles 178, , 279 of the Labor Code of the Russian Federation.

Calculation of payments upon dismissal

The settlement period for all these payments, including for the average earnings retained for the second and subsequent months of the employment period, is the same. This is 12 calendar months before dismissal. Moreover, if you dismiss an employee on the last day of the month (that is, this is the last day of work for the employee), then this month is included in the billing period. If the dismissal is made on any other day of the month, then the billing period is 12 calendar months before the month in which the employee was dismissed Art. 139 of the Labor Code of the Russian Federation; clause 4 of the Regulations, approved. Decree of the Government of December 24, 2007 No. 922 (hereinafter referred to as the Regulation).

The calculation of payments upon dismissal is not affected in any way by the remuneration system used in the organization: salary, piecework, based on hourly, daily or monthly tariff rates.

Under the usual accounting of working time, payment is subject to working days for the months after the dismissal on a five-day or six-day working week, depending on the operating mode of the organization, falling on the paid period, that is, for a specific month after the dismissal clause 9 of the Regulations. At the same time, the severance pay paid on the day of dismissal must be calculated for the working days falling on the first month after the day of dismissal.

To calculate the severance pay (earnings for the period of employment), the average monthly earnings in this case can be calculated using the formula e

Dismissal payments are financial support guaranteed by labor legislation for an employee in the event of dismissal for reasons not guilty of him. As a rule, by the time the employment relationship is terminated, the employee has unused vacation in full and wages not received for the time actually worked. This money must be paid on the last day of work. We tell you what other payments upon dismissal are due to the employee.

Voluntary dismissal

If a person leaves on his own, then along with his labor he will receive the rest of his salary and monetary compensation for all non-vacation days. The premium will be paid according to the local act of the company. Often it depends on the developed norm: the month must be worked out completely, therefore, if you leave in the middle of the period, you should not count on the bonus. And it is hardly possible to develop a certain plan for part of the month, on which the accrual of incentive payments also depends. In any case (this is about the award), it is necessary to focus on the LNA, which regulates this issue (award).

The final settlement upon dismissal of one's own free will does not imply any additional compensation.

Dismissal on this basis involves settlement with the employee on the last day of his work, which includes the following types of charges:

- salary;

- compensation for vacation that was not used;

- different forms of payments provided for in other documents of the organization (for example, in collective, labor agreements).

Another situation is when the number of vacation days due to an employee is used in advance. In this case, the employer withholds the required amount from the salary during the final settlement.

If an employee is absent on the day the employment agreement ends at the workplace and it is impossible to receive payments, he has the right to demand the due amounts at another time. The employer must return the funds no later than the date following the day of application.

It is important to remember that if the employee, according to the application agreed by the employer, was granted leave with subsequent dismissal of his own free will, the day of calculation will be the date preceding the day the leave begins. It is on this date that the employer must do two things:

- issue a work book;

- make the necessary payments upon termination of the agreement.

Termination of the employment contract at the initiative of the employee during the period of illness is also possible. With this option, payments are made on the last day of work (even if it falls on sick leave dates). However, if the employee is unable to appear on that date, all due amounts will be paid no later than the day following the day the claim for payment is made.

Dismissal by agreement of the parties

The parties agreed to terminate the employment contract. What payments are due upon dismissal on this basis? The Labor Code of the Russian Federation does not contain conditions for the payment of minimum or maximum amounts to an employee in excess of wages and vacation compensation. Everything, as in the case of care of one's own free will. But if interpreted literally, then the "agreement of the parties" allows you to agree on some additional conditions, including not forbidden to pay the employee money as compensation. The amount is at the discretion of the employer. It turns out that the calculation of an employee upon dismissal by agreement of the parties may be more significant than the legally established minimum.

The types of payments due upon termination of the agreement on the last day of work on the basis under consideration consist of:

- employee salary for the period worked;

- compensation for vacation not used by the employee (if any, payment is made taking into account all days of rest that were not used, in the amount of average earnings);

- other due amounts (for example, bonuses);

- severance pay (if it is defined in the collective or labor agreements).

Dismissal at downsizing

Upon dismissal, the employee must receive a calculation that will include standard payments in the form of salary balances and non-time off, as well as a severance pay in the amount of average earnings. The average earnings will be saved for the second and even the third months (and in some cases up to six months (Article 318 of the Labor Code of the Russian Federation)) provided that the former employee is registered with the employment service and there is no fact of his employment.

When parting with the employer in the event of a reduction, the employee has the right to receive a calculation that includes the following items:

- salary and other payments for the period preceding the day the labor agreement expires;

- amounts of money due for unused vacations;

- severance pay in the amount of the average monthly salary (the labor or collective agreement may provide for a larger amount of payment);

- additional compensation in the amount of average earnings in proportion to the period before the expiration of the notice of dismissal (if the employee agrees to part with the employer before the expiration of the notice of dismissal - two months).

A person who is in a difficult life situation may apply upon dismissal to maintain the average monthly earnings for the third month. To receive such a calculation, a person must meet the following conditions:

- within two weeks after dismissal, contact the employment service;

- the person is not employed by this service during the third month after the termination of the contract;

- receive a decision on the right to receive payments for the third month from the employment service to provide the employer.

If the employee is not paid on the last day of work or on the next day after they present their claims due upon dismissal to reduce the amounts, the employer must pay them, taking into account interest. The amount of such compensation is not less than 1/150 of the current rate of the Central Bank of the amount of unpaid funds in a timely manner for each overdue day. The countdown starts from the day following the due date of payment to the date of actual settlement. A collective or labor agreement may provide for higher amounts of compensation.

In case of refusal to transfer to another job and dismissal for medical reasons

Article 178 of the Labor Code of the Russian Federation obliges to pay an allowance in the amount of two weeks of earnings if the employee is dismissed due to a deterioration in health - he cannot perform his previous functions, according to a medical report. It should be remembered that before terminating the employment contract, the employee must be offered other vacancies that suit him for health reasons.

Thus, payments to an employee upon dismissal for medical reasons consist of:

- salaries;

- holiday compensation;

- severance pay.

Other cases

How to calculate an employee upon dismissal if he moves to another city? Just like leaving on your own. If we are not talking about the relocation of an employee who leaves after her husband, a military man. Such a woman is entitled to a severance pay in the amount of two weeks of earnings (paid from the budget).

The liquidation of an organization implies payments, as with a reduction.

Article 178 of the Labor Code of the Russian Federation provides for a number of other situations when an employee receives additional money (two-week earnings):

- conscription;

- reinstatement of a person who previously held this position;

- if a person refuses to follow an employer who transfers activities to another locality;

- recognized incapacity of a person;

- refusal to continue working in the new conditions.

Vacation pay calculation

When terminating the agreement, the employer is obliged to provide monetary compensation for unused vacation accumulated during the entire period of activity in a particular institution. The accounting department must make an accurate calculation of the number of days included in the employee's working period.

Leave is defined as follows.

Step 1. Divide the number of days of annual leave by the number of months in a year and multiply the resulting figure by the number of months actually worked in the period.

For example, an employee has 28 days of vacation. Before leaving, he worked for 4 months. We count in the following way:

28 days / 12 months = 2.33.

2.33 × 4 = 9.32 (number of days of unused vacation).

Step 2. The number of unused days is multiplied by daily earnings, for example, 800 rubles.

9.32 x 800 = 7456.

This is the compensation amount. Personal income tax in the amount of 13% will be withheld from it.

When Not to Hold

In some situations, defined by law, it is prohibited to deduct money from the calculation of the employee in advance of the used vacation. These include cases:

- liquidation of the institution;

- layoffs;

- termination of the employment contract due to illness due to the inability to continue to fulfill the duties of the position;

- conscription for military service;

- loss of ability to work;

- reinstatement in a previously occupied position;

- termination of the employment agreement due to circumstances beyond the control of the employee and the employer.

Responsibility for violation of payment deadlines

In accordance with Art. 140 of the Labor Code of the Russian Federation, the employer must make all the necessary settlements with the employee upon dismissal on the last working day. In case of violation of the established terms of payments, non-payment or incomplete payment of the due funds within the period specified by the legislator, the employer will be fined.

The amounts of fines are established by Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation and are:

- for an official - 10,000-20,000 rubles;

- for individual entrepreneurs - 1000-5000 rubles;

- for a legal entity - 30,000-50,000 rubles.

Ask questions, and we will supplement the article with answers and explanations!

The dismissal of an employee can occur for various reasons, including at his own request. However, many employees do not seek to terminate their activities in the organization on their own, fearing that in this case they will not be able to receive any material compensation. At the same time, certain payments are also due upon dismissal of one's own free will.

At the request of the employee

According to labor law, the termination of a working relationship can occur both at the initiative of the organization's management and at the request of the employee. The employee is not obliged to explain the reason for the desire to quit, but he must warn in advance. The employer, however, cannot ignore the application of the employee and is obliged to dismiss him in due time.

Often, employers force an employee to write a statement of their own free will in order to accrue the minimum amount of compensation. If an employee has an idea of his rights, he is more likely to defend his financial capabilities.

The dismissal process is carried out only if there is a written application from the employee, handwritten or printed on a printer. The application is issued in a standard way: in the upper right corner the name of the institution, position and full name of the head are indicated, below the data of the employee. In the center, the “Statement” is written in large letters, and below the text of the application itself, in which such expressions as dismissal, termination of employment or termination of the employment contract must be present. Under the text on the right is the signature of the employee and its transcript, as well as the date the document was drawn up.

An application is submitted to the head of the personnel department, directly to the head or his secretary. It is also possible to send by registered mail. If the employee is financially responsible, he must attach to the document an inventory of the property that he owns.

Sample letter of resignation

Submission deadlines

The standard processing time for an application is 2 weeks, but it may vary for individual companies. So, according to the labor code, for those hired on or under a short-term agreement for 2 months, as well as seasonal workers, the period is 3 days. For the CEO - 30.

Working off upon dismissal of one's own free will in 2018

In some cases, management may require mandatory training, which is included in the established norms. Some categories of citizens may resign in case of dismissal of their own free will in 2018:

- an employee of retirement age;

- citizens who have completed the competitive selection for a vacant place in a municipal, regional and other state entity;

- persons enrolled in full-time education in secondary technical or higher educational institutions;

- employees whose rights have been violated by the management of the organization.

The procedure for dismissal at will in 2018

Adjustments in the legislative regulation of the process of dismissal occur regularly, as a rule, they are insignificant. In 2018, voluntary dismissal has the following sequence:

- writing a statement indicating the date of termination of work and the reason for its completion;

- submission of an application to the management and its endorsement;

- signing a dismissal order;

- completion of the remaining term;

- accrual of benefits upon dismissal of one's own free will;

- receipt of documents and due payments;

- verification of the correctness of payment of compensation upon dismissal of one's own free will;

- ending the relationship with the organization.

All procedures are regulated by law. First of all, this is the Labor Code of the Russian Federation, articles 80, 81, 71, 280, 127, 77, 64. Articles devoted to payments to an employee upon dismissal - 84 and 140.

Can an application be withdrawn?

Even a correctly executed application for dismissal of their own free will, the employee can withdraw. He needs to complete this within the two-week period used for working off. At the same time, management cannot refuse an employee without good reasons. Such reasons may be:

- admission to this position of disabled people or citizens of other preferential categories;

- if there is a replacement, which was issued by an external transfer, and the new employee has already started work.

In other cases, the withdrawal of the application is made in writing, indicating the same data as in the application for dismissal.

Final payment - when will it be received?

Compensation payments to the departing employee are paid according to the terms written in the application. The proposal to make voluntary termination payments 2018 at the same time that all other employees receive their salary is not valid. Funds may be paid at other times when:

- the employee quit immediately after the vacation, since the payment of vacation pay and payroll is issued simultaneously on the last day of work;

- During the working period, the employee was on sick leave. In this case, payments are made the next day after presentation;

- the employee did not appear at the place of work within the specified period, then the payment is made the next day after the receipt of the claim for compensation payments.

Are management fined?

If compensation payments were not made on time or in sufficient quantities, the resigned employee has the right to file a complaint with the Labor Inspectorate and demand additional compensation for moral and material damage. This requirement is regulated by Article 236 of the Labor Code, and the amount is 1/150 of the Central Bank rate in force at the time, it is added up for each day of delay.

In addition, the organization will be required to pay a fine, the amount of which can reach 50 thousand rubles, and a penalty of up to 20 thousand rubles is imposed on the head of the enterprise.

What payments are due upon dismissal of one's own free will 2018

- salary taking into account the period of working off;

- based on the number of days that have passed since the last vacation or the moment of employment;

- bonuses and allowances in accordance with the regulations of the organization or higher authorities.

An employee is not entitled to severance pay upon dismissal of his own free will, but can be paid in agreement with the management.

- When leaving work of his own free will, the employee may receive benefits over the next 6 months, however, it will be minimal;

- Pressure from management and trying to force an employee to write a statement of their own free will is illegal. Thus, some managers try to save money in order to make fewer compensation payments. In such a situation, it will help, however, it is desirable that the employee has some evidence in his hands. Ideally, if written.

- Documents are issued and compensation is paid on the day of dismissal. If on this day, the employee has the right to sue and receive financial compensation for the delay.

Dismissal is a process known to almost every adult who has a job. This procedure has a huge variety of features and nuances. You can get fired for a variety of reasons. Termination of employment relations at the initiative of the employee is becoming more and more common. How does this process take place? And what payments are due in this or that case upon dismissal of one's own free will? We will have to answer these questions next. If the employer does not pay off his subordinates, the dismissal will be considered violated. This can lead to a number of negative consequences for the former boss.

When can you quit

It is necessary to think about what payments upon dismissal of one's own free will are due to a citizen in advance. But before the calculation, the employee must tell the employer about his intentions. When is it permissible to terminate an employment contract?

Anytime. Each subordinate can quit when he sees fit. This right is regulated by the labor legislation of the Russian Federation. At their own request, it is allowed to quit not only during working hours, but also on vacation. There are no restrictions on this. Is that the employer must be notified in advance of their intentions.

Working off

Upon dismissal of one's own free will, payments to one degree or another are due to everyone leaving work. They are made after the entry into force of the application of the established form. As already mentioned, it is necessary to inform the employer in advance about plans to leave the company. By law, a citizen will have to work 14 days after submitting an application in the prescribed form for termination of employment.

Working off is a mandatory item upon dismissal. However, sometimes you can get rid of it. For example, to negotiate with the employer or go on vacation, filing a parallel letter of resignation. This or that decision will slightly affect the amount of payments.

If a new employee wants to quit while on probation, he will have to notify the employer 3 days before leaving work. He will still be paid.

When the calculation is made

The next important nuance is when a person receives money from the employer that is due to him by law. This must be remembered by every subordinate.

Payments after dismissal of one's own free will are provided on the day the order to terminate the employment relationship enters into force. It is impossible to demand funds immediately after submitting an application of the established form. After all, throughout the entire working out, the employee can change his mind and pick up the document.

If at the time of termination of the employment relationship a person was not at the workplace, the calculation is made no later than the next day after the former subordinate applied for the money due.

List of mandatory payments

What payments upon dismissal of one's own free will are due to a citizen in an organization? There are mandatory and optional compensation. Let's start with what is provided to each subordinate.

So, the mandatory payments upon termination of employment at the initiative of the employee include:

- calculation for hours worked;

- payments for unused vacation.

There are no further mandatory payments. What is meant by each item?

hours worked

Upon dismissal of one's own free will, payments for the time worked by a citizen are a mandatory payment. It is set for the days in a particular month that a person spent in the company, performing his job duties. The calculation is made in the accounting department according to a special certificate.

The salary is given to a citizen just in the form of a payment for the time worked in a month. For example, an employee receives a salary of 40,000 rubles. In March, he worked 10 days out of 20 workers, quitting on March 20. Then the employee is entitled to 20 thousand rubles when leaving work.

Vacation

The following payments are due upon dismissal of their own free will to almost all subordinates. Most often they take place. We are talking about payments for unused vacation. By law, every employee is entitled to paid annual leave.

If a citizen did not receive it, but decided to quit, one can demand appropriate compensation from the employer. At the same time, the period that a person spent at the workplace without a vacation is rounded off according to the usual mathematical rules. This means that when working for 6 months and 20 days, we can assume that the subordinate did not rest for 7 months. If the employee worked 5 months and 4 days, only 5 months are taken into account.

The calculation is made taking into account unused days of vacation and the salary of a citizen. Usually, upon dismissal of one's own free will, payments for rest and for hours worked are made at the same time.

Compensation

We have dealt with the obligatory funds. Was there a voluntary dismissal? What payments are due to some employees?

A number of citizens, under certain circumstances, can count on the payment of so-called compensation. Its size is set directly by the employer. Usually, compensation is not negotiated with subordinates.

This payment in Russia is extremely rare. Only employees with whom this money is specified in the contract can claim compensation.

In some cases, severance pay is assigned at a general meeting in amounts agreed with subordinates. This money will be issued without fail upon termination of the employment relationship.

Dismissal procedure

Now it is clear what payments upon dismissal of one's own free will are due to the employee in this or that case. And how to get them? What is the procedure for terminating relations between employers and subordinates?

A citizen who decides to quit must adhere to the following algorithm of actions:

- Write a letter of resignation. Give it to the boss 14 days before the wish comes into force.

- Work for 2 weeks according to the law. You can go on sick leave or vacation in order not to work out the allotted time.

- After 14 days, the employer issues a dismissal order. The citizen gets acquainted with it and puts his signature. If the employee refused to get acquainted with the document, the head draws up an act.

- From the employer on the last working day, the subordinate takes the work book with a record of the termination of relations, the pay slip and signs the receipt of the papers.

- In the accounting department, using the issued sheet, payments are calculated upon dismissal of one's own free will with the issuance of the required funds. It is necessary to put a signature on the receipt of money in a special magazine.

That's all. Once a subordinate has received all his papers and cash, he can be considered fired. But that's not all.

sick leave

If a citizen falls ill within a month from the moment of dismissal, he may demand from the former boss payment for sick leave on a sick leave. Only these funds have certain features.

Namely:

- according to the certificate of incapacity for work, only citizens who are not working after dismissal can receive sick leave;

- the sheet is presented no later than six months after the termination of employment in a particular company;

- the amount of payments is 60% of the salary.

Important: work experience in this situation is not taken into account. Disability certificates issued to close relatives are not paid. This is a normal, legal occurrence.

Retention

Was there a voluntary dismissal? What payments are due to a citizen in this case? The answer to this question will not cause more trouble. It should be remembered that each employee receives compensation for vacation and hours worked without fail. But under certain circumstances, the employer can withhold part of the funds. What is it about?

Withholding of payments takes place only in relation to unused vacation. If an employee booked a holiday in advance, compensation for it is not due. Moreover, the subordinate must pay 80% of the vacation pay in advance on his own. By law, the employer has the right to withhold 20% of the salary.

Therefore, sometimes upon dismissal of one's own free will, payments are issued in incomplete amounts. Withholding is the right of the employer. But without reason to hold money is prohibited.

Results

Was it a voluntary resignation? What payments are due to a subordinate? The answer to this question will not cause much trouble. What deadlines need to be met? Payments upon dismissal of one's own free will are due on the day the employment relationship is terminated. Or one day after the person's request for payment.

No more funds are required by law for the termination of relations between a subordinate and an employer. They cannot be required. But it should be remembered that each boss is obliged to provide payments both for hours worked and for unused rest. Anyone can claim these compensations.

In fact, remembering what payments are due upon dismissal of one's own free will is easier than it seems. There are not so many payments, they are calculated taking into account the salary of the employee and the number of days worked / available days of rest.