Calculation of the participation rate. Calculation of KTU - coefficient of labor participation

One of the effective tools that can be used by the employer when calculating the wages of employees and shaping the motivation of workers is the labor participation rate (KTU). It allows you to evaluate the contribution of each employee to the achievement of the overall result and makes it possible to create a fair system of remuneration through the use of KTU in the organization. However, it should also be remembered that the labor participation rate has its advantages and disadvantages - KTU can be both relevant in some cases, and practically useless or even harmful in other conditions.

What is the labor participation rate

First of all, the labor participation rate is an indicator according to which the direct contribution of an individual employee to the activities of the entire organization or a separate structural unit is assessed. It is used to calculate the direct level of wages of employees directly, which, when used, makes it one of the most important statistical indicators in an enterprise or within one structural unit.

Most often, KTU is used in the case of team work, where the overall success directly depends on both the individual work of workers and the direct activities of the entire team as a whole. There are two main options for the use of KTU:

- At . In this case, the KTU can influence the entire amount of wages if the requirements of the law regarding the implementation of basic guarantees to employees are observed.

- At . In such a situation, the work of employees can be paid according to the established salary or in accordance with the tariff as the main part of the salary, and the KTU directly affects the amount of additional payments to employees for the performance of their tasks.

It should also be noted that the use of the coefficient of labor participation in the Labor Code of the Russian Federation is not directly considered in any way. That is, the application of this method of calculating wages and the specific mechanisms for its use depend solely on the desire of the employer and the relevant internal regulations of the organization. However, attention should be paid to the fact that the use of KTU is possible only if such actions do not violate the requirements of the law. Therefore, before introducing the aforementioned remuneration system, it is recommended that you familiarize yourself with the provisions of the following articles of the Labor Code of the Russian Federation:

- Art.8. Its provisions provide the employer with the opportunity to adopt local regulations governing the specifics of the labor process in the organization, including in matters of remuneration in general, provided that they do not worsen the position of employees in relation to the basic guarantees and requirements of the current labor legislation.

- Art.57. The norms of the aforementioned article provide legal regulation of the direct content of contracts concluded between employees and employers. In particular, the text of the document must also mention the system of remuneration used.

- Art.72. The principles of this article consider the possibility of changing employment contracts. Pay attention to its provisions should be all employers planning to introduce KTU in the organization after the start of its work - since the use of labor participation rates will also imply a change in the current wage system.

- Article 74. The main legal norms of this article regulate the possibility of unilateral change in the terms of employment contracts by the employer - in the case of the introduction of CTU, the employer has the right to focus on its provisions in order to encourage employees to agree with the new work procedure or be able to dismiss them in the absence of such consent.

- Art.135. This article discusses the concept of wages in general, possible ways to establish it and the general legal regulation of the principles of calculating wages for employees. In particular, the provisions of this article allow employers to independently develop and implement payment systems, if they do not contradict the norms of the Labor Code of the Russian Federation and violate the rights of employees. At the same time, the employee should always be able to accurately and in detail familiarize himself with all the features of calculating his salary.

KTU can only be applied in cases where there is a collective activity. If employees work in individual projects, and do not perform collective tasks, and also simply in relation to assessing the quality of work of an individual employee in isolation from the team, the use of KTU is impossible in principle.

Advantages and disadvantages of KTU

Like any wage system, KTU, as a complex, has certain advantages and disadvantages. The advantages of using the labor participation rate include:

However, KTU also has certain disadvantages.:

- collective component. The use of KTU is relevant only in relation to certain groups of employees. Thus, far from all positions and specialties, this method of remuneration can be applied in principle.

- Inapplicability in certain areas of activity. The labor participation coefficient is used primarily in those areas of work where the labor of employees directly affects the formation of the organization's income and has a certain material embodiment, and can also be fairly easily assessed according to the specified criteria. With regard to employees who are not directly related to the production process and have a direct impact on the economic performance of the enterprise, the use of KTU is inefficient.

- Subjective assessment risks. The use of KTU with the wrong choice of factors affecting the coefficient or with the imperfection of assessment methods can lead to an extremely subjective use of the aforementioned system, when the actual value of the distributed coefficients is not carried out in accordance with the real achievements of employees, but is used by managers in their personal interests.

The introduction of KTU at the enterprise - a step-by-step procedure for establishing the coefficient of labor participation

To introduce KTU in an organization, the employer should take care of the correct design of this process from a procedural point of view. Despite the fact that the practical implementation of KTU can seriously differ depending on the specifics of the work of a particular organization, in the general case, the step-by-step procedure for establishing the labor participation rate at an enterprise may look like this:

- Formation of the KTU system. The employer should develop the KTU system used, determine the procedure for establishing labor participation rates. This can be done in a variety of ways, including by dividing various jobs and actions by points, as well as by determining penalties for various misconduct. Points can be awarded depending on the direct complexity of the work, actually worked shifts or manufactured products, additional actions, and removed - respectively, for missed working days, damage to products or the release of defective products and other actions that reduced the quality of the overall result.

- Fixing the KTU system in the local regulations of the enterprise. Employer it is mandatory to record in the internal documents of the organization all the features of the KTU system used and its impact on the formation of employees' wages. At the same time, this information should be available to employees, and employment contracts with them should contain at least references to current local regulations.

- Holding If KTU is already established in relation to existing employees of the enterprise, then the employment contract should be amended by concluding an additional agreement. However, if the employees do not agree with the new system, the employer should justify the implementation of the KTU with organizational or technical changes, and familiarize the employees with them two months before they come into force. Dissenting employees may in this case be dismissed or transferred to other positions at the end of the specified period.

The employer is obliged to ensure that employees receive the minimum wage in the amount corresponding to the minimum wage, taking into account various additional factors. It is possible to pay wages below the minimum wage only in cases specified by law, more details about which can be found in a separate article.

It should be remembered that in relation to individual payments, it is unacceptable to use KTU. Such cases where it is impossible to use the coefficient of labor participation include the following situations and types of payments:

- Compensation for dangerous or harmful working conditions.

- Overtime pay.

- Extra pay for night work, work on weekends and holidays.

- Regional additional coefficients.

- Bonuses and other payments not related to labor results and the KTU system, for example -.

- Compensation payments and financial assistance.

How to calculate labor participation rate - formula

Each employer and HR worker, as well as direct managers in whose activities KTU is applied, should know how to calculate the labor participation rate. The specific KTU formula will directly depend on the characteristics of the system and mechanisms used in a particular organization. However, in general cases, the formula for calculating the labor participation rate is as follows:

KTU \u003d (BS / B1 + B2 + ... + BN) * K

Where KTU is the coefficient of labor participation, BS is the personal assessment of the worker's work, B1, B2, BN are the assessments of other employees, and K is the total number of employed employees in relation to which the KTU is applied.

An example of calculation in these cases is the situation when the coefficient for one five-day working week is determined for a team of 10 people. The work of the foreman has a basic difficulty of 3 points, the work of the welder - 2 points, and the work of ordinary fitters - 1 point.

Five installers fully completed the tasks assigned to them within the allotted time and received, respectively, one point each.

The foreman also completed his tasks in general and received 3 points, however, due to problems in ensuring the work of the entire unit, he received a penalty of 1 point, and in total he has 2 points.

One of the welders missed one of the working days for a good reason, while on the other days he worked in a normal mode and therefore he receives 2*4/5=1.6 points.

One of the installers made a mistake in his work and was fined 0.6 points according to the results of his work and has only 0.4 points according to the results of the week.

Another installer, on the contrary, corrected the mistake made by the previous employee, for which he was given an allowance of the corresponding 0.6 points and his KTU as a result corresponds to 1.6 points.

The last welder to complete the task went out on a day off and received an additional 0.4 points for this, and his KTU was 2.4 points.

In total, all employees have 1+1+1+1+1+2+1.6+0.4+1.6+2.4= 13 points. The payment for the working week of the brigade is 130 thousand rubles, respectively, the distribution of wages in this case will look like this:

A welder who leaves on a day off receives 24 thousand rubles, as well as an allowance in the form of a double payment for that day, which cannot be a component of the CTU. Thus, one working day of this welder is estimated when considering a week at 4 thousand rubles - and at 8 thousand rubles for work on a day off. In total, his salary will be 28 thousand rubles.

This is only an approximate and simplified version of the calculation of the labor participation rate, which makes it possible to assess the capabilities of this system as a whole. It must be understood that its practical implementation can cover a much wider range of features and nuances of labor activity, various mechanisms for remuneration of employees and other aspects of labor.

Note. Lord students! Read the comments to the task carefully, because, unfortunately, in educational institutions often the teaching staff gives tasks without understanding the nuances of what they require from poor students. This solution demonstrates the difference between what is taught at the university and in real life. Please note that the solution to the problem will change each time, depending on the date on which the problem is solved, because legislative changes fundamentally influence its decision..

Task. Distribute between the individual members of the brigade the total earnings (salary and bonus), which amounted to 13,000 UAH. Taking into account the hours worked, the assigned category and the coefficients of labor participation (based on the table data). Draw conclusions.

Preliminary comment. The condition of the problem is given in accordance with the original, which is given as a problem for students. I give it as it is, expressing my sympathy.

A comment. The first conclusions are very sad and do not relate to the task at all. Firstly, a painter and a bricklayer are professions, a master is a position. Bringing them in one list as a condition of the problem - should be ashamed. The position does not have a rank, only the profession has this sign.

Let's move on to the third column. Since the average amount of working time in a month is 168 hours, we pay attention to the bricklayer. Overtime must be paid as overtime. Therefore, we will try to find out whether such an event could have occurred without overtime. Based on the working time calendar, we find out that this was possible in 2009 in July. The number of working hours is 184. The next similar month we have is December 2010, but it has not yet come and there are 183 hours.

Since we have determined the date absolutely accurately, using Art. 95 Labor Code of Ukraine, Art. 21 of the Labor Code of Ukraine and looking at the minimum wage established from 07/01/2009, which is equal to 630 hryvnia (and was valid until 09/30/2009), we will come to the logical conclusion that the minimum hourly wage rate of the 1st category at the moment should be 630 / 168*1.20=4.50 . 1.2 - coefficient according to the General Tariff Agreement. Considering the content of the second column, we will use the table:

| Discharge | 1 | 2 | 3 | 4 | 5 | 6 |

| Discharge ratio | 1,0 | 1,1 | 1,35 | 1,5 | 1,7 | 2,0 |

Thus, the condition of the problem should look approximately (!) as follows:

I'll tell you why "about". The fact is that the tariff scales and the number of categories at the enterprise are a matter of the enterprise itself, the industry agreement and the trade union. Thus, the tariff scale I used is one of the most common, but by no means the only one. Therefore, the hourly rate is defined by me as theoretically possible for these categories in the industrial sector.

But the most interesting is ahead. The point is that, in accordance with Art. 252-7, the team of the brigade can distribute collective earnings using the coefficient of labor participation (hereinafter - KTU). But...

The procedure for the application and determination of KTU is established in the team in accordance with the regulations in force at this enterprise, approved by the head of the enterprise in agreement with the trade union committee. We arrived. There is not a word about this in the conditions of the task. This means that by making ANY of our own assumptions about the distribution of the bonus fund, we will be right. In the end - ANY decision will be correct.

Solution . Let's solve the problem based on the corrected initial data.

The amount that must be paid to employees in accordance with applicable law on the basis of hours worked and hourly wage rates is:

The total amount, respectively, will be: 1021.44 + 1346.40 + 1242.00 = 3609.84

Thus, it is necessary to distribute 13000-3609.84=9390.16

The distribution of the bonus fund will be carried out on the basis of the assumption that its distribution occurs on the basis of the accrued payment for the hours worked, taking into account the KTU. That is, for the calculation, we will compile the following table:

The sum of the products of payments on KTU is equal to 3577.344, so the premium due will be equal to the quotient of the payment and KTU by 3577.344 and all this multiplied by the amount of bonuses to be distributed (9390.16).

Payment according to established tariffs is not the only way to calculate remuneration for work. The tariff-free method provides for special forms of labor accounting invested by each individual employee. It is usually used if the result of labor is the fruit of a collective effort.

Allows you to evaluate the achievement of each individual employee and calculate remuneration on this basis.

How this coefficient is calculated, in what units it is fixed, how earnings are distributed with the help of KTU and other subtleties related to collective labor and its payment, we consider in this article.

Why is KTU needed?

Labor participation rate (KTU)- a quantitative indicator characterizing the degree of contribution to the overall labor process and the result of each of its participants.

It is used in those forms of organization of the labor process that imply collective participation. The result is ensured by joint efforts, but the payment must be assigned separately, so a measure is needed that serves as the basis for the distribution of remuneration.

This is one of the forms piecework payment, when the monetary reward paid to each employee depends on the quantity of products produced (in this particular case, the products were produced by the entire team), and on the price per unit of output.

REFERENCE. Most often, KTU is used in brigade forms of labor organization, when the earnings due to the entire brigade for the work performed are distributed depending on the time worked and the qualifications of each employee.

KTU at established tariffs

The coefficient of labor participation is taken into account not only with the tariff-free organization of the payment of labor remuneration. Another area of application of the CTU is the distribution of a part of the labor remuneration fund, which is not included in the established tariffs. Such components of wages may include:

- a bonus paid for achieving any indicators above the norm;

- savings in the salary fund;

- lump-sum payment as a result of the revision of temporary or other rules, etc.

With such an accrual, the part that is due according to tariffs is deducted from the earnings of the entire team, and the rest of the amount is distributed in accordance with the KTU.

IMPORTANT! Whether tariffs are applied in this system of labor organization or not, KTU can only be applied in a collective form of work.

Distribution of funds by KTU

Depending on the form of payment for group labor, KTU is applied as follows:

- with a tariff-free system: the total amount to be paid for the entire team is divided by the number of employees, and then this average, corresponding to indicator 1, is adjusted based on the KTU;

- when distributing payment in excess of tariffs: employees receive a "fixed" amount according to the tariff, and the rest of the funds are divided taking into account KTU.

Where can not apply KTU

Collectivity of labor is the main condition for the application of KTU. The labor participation rate cannot be applied to any form of individual payments. The forms of remuneration, where KTU is fundamentally inapplicable, include:

- compensation for hazardous work;

- overtime payments;

- additional payment for work on a holiday or day off;

- money for work on the night shift;

- additional amounts for supervision, mentoring, management of a team, department;

- allowances for qualifications and experience;

- awards for rationalization proposals or professional discoveries;

- all kinds of benefits.

Who installs the KTU

In the Labor Code of the Russian Federation there is no regulation regarding the accrual of earnings according to KTU, this issue is left to the discretion of the labor collective. The algorithm can be anything, the main thing is that it does not contradict the current provisions of the Labor Code and other legislative acts.

IMPORTANT INFORMATION! No matter how the earnings are distributed, the amount received by each member of the team cannot be less than the tariffs for such work performed within a specified period of time.

Digital value of KTU

The base value of the labor participation coefficient is taken as one. Index 1 means that a member of the labor collective, performing joint work, fulfilled all the requirements, was able to comply with the norms for time, quantitative and qualitative characteristics, while not making mistakes that worsen the overall result, and strictly observed the requirements of discipline and labor protection.

In calculations, the resulting figure may be in the range from 0

(a member of the brigade did not participate in the common work or committed serious violations that nullified his general benefit) up to

2

(more done than stipulated by the norms of time, quantity and quality).

At the end of each period of work of the team (team), a special protocol according to the established methodology calculates the KTU of each worker. The KTU criteria should be set as objectively as possible (they can be “own” for each individual enterprise).

The formula for calculating the coefficient of labor participation

To calculate the KTU, you need to use the system of set parameters, each of which is assigned its own "score". The employee is assessed for each parameter, receiving a certain number of points for all in turn. The points are added together.

To apply the formula, you also need to know the exact number of employees that will share the total participation. The calculation can be done like this:

KTU \u003d (O / O1 + O2 + ... + On) x N

- KTU - coefficient of labor participation;

- О – grade assigned to the employee whose participation rate is being calculated;

- O1 + O2 + ... + On - the sum of the points of all employees;

- N is the number of team members.

Features of calculating KTU

Imagine a team for which the following parameters for evaluating its work have been developed:

- the complexity of the work (on a three-point scale: the most difficult work - 3 points, medium - 2 points, easy - 1 point);

- loading by time (maximum - 3 points, average - 2 points, minimum - 1 point);

- work on equipment (1 point for each type);

- equipment maintenance (2 points for each case);

- quality (1 point for compliance and 1 point for control);

- responsibility for the results (up to 3 points, can be minus in case of violations).

The Excel computer program is convenient for calculating KTU, where all indicators are visible in tabular form, and the last column displays the total for each employee.

An example of remuneration calculation according to KTU

Suppose that in our conditional team there are five workers engaged in the manufacture of stools during a specified time period. For the implementation of the plan, their team is entitled to a payment of 1000 monetary units (we will take a conditional value for calculations).

First worker fully fulfilled the plan, complied with all the norms, having worked the prescribed number of working hours, that is, his KTU is 1.

Second worker overfulfilled the norm by a quarter, the rest of the indicators are the same as those of the first. KTU will turn out 1.25.

Third employee fulfilled the norm, but due to his fault (non-compliance with the rules for working with equipment), the woodworking machine was broken, which forced the work to be suspended. In addition, he was several times late for the start of the working day. Therefore, several points were deducted from him, and his KTU was 0.5.

Fourth employee fixed a breakdown in a woodworking machine, qualifications allowed me to do this. He was given points for equipment maintenance, in addition, the management noted the quality of his work, and his KTU turned out to be 1.6.

Fifth employee took off on the last day of work. His work did not cause complaints, but in fact he worked a little less than the others, so the KTU decreased to 0.65.

Now let's calculate the share of each employee, which he will receive with the tariff-free method of payment, or the additional remuneration laid down as extra earnings, with the established "fixed" tariff.

The sum of all KTU: 1 + 1.25 + 0.5 + 1.6 + 0.65 = 5.

With tariff-free payment, the total amount will be distributed as follows: 1000 / 5 = 200 (the average share corresponding to a unit of KTU). Then employees should:

- 1st employee will receive 200 (units of account);

- 2nd - 200 x 1.25 = 250;

- 3rd - 200 x 0.5 = 100 in total;

- 4th - 200 x 1.6 = 320;

- 5th - 200 x 0.65 = 130.

Thus, thanks to KTU, earnings were unevenly distributed, some employees received significantly more than others. However, this is due to objective factors, so it will not cause a feeling of injustice and discontent in the brigade.

KTU is a numerical indicator of the work of an employee. At the same time, taking into account various kinds of criteria and using a special formula, it is possible to calculate who worked and how. As a rule, such a calculation is necessary for the calculation of allowances and additional payments to the salary. In the article, we will dwell in more detail on the scope and procedure for calculating the KTU.

Scope of KTU

KTU is a quantitative expression of the participation of a particular employee in the overall production process.

The coefficient of labor participation, as a rule, is necessary to calculate additional allowances or surcharges. For comparison: if we take into account only the norm of hours worked and the employee's qualifications (rank), then this gives rise to the depersonalization of labor. In turn, KTU “helps” the employer to understand who and “how much” has invested in the process.

Despite the fact that the Labor Code of the Russian Federation does not contain such a term as KTU, in practice more and more employers, especially when it comes to team (team) work, resort to such an assessment of labor. Of course, from one worker there will be no such result as from team work; but the employer clearly sees who really worked.

Please note that KTU cannot be used to calculate the salary for the position. This type of earnings cannot be changed without objective reasons (for example, a change in position, a decrease in the number of working hours, etc.), and if, for example, KTU is less than 1, then this automatically reduces the amount of earnings to which the coefficient is applied. Since the legislator prohibits worsening the position of an employee in comparison with the Labor Code of the Russian Federation and making his earnings, which was agreed upon when hiring and included in the text of the employment contract, do less depending on the indicators, it can be concluded that it is advisable to apply KTU for calculation of incentive payments.

As noted above, KTU is used in the collective form of wages, which is one of the types of piecework wages. At the same time, KTU can be used for:

- Distribution of total earnings for the entire team.

- Allocations of additional, saved or over-allocated funds.

An example of distribution by KTU can be, for example, a bonus for increasing production volumes, savings on the salary fund, etc. The organization has a saved wage fund of 50,000 rubles. The head decided to issue a bonus to the entire team. For the purpose of distributing the amount, the KTU coefficient is used.

At the same time, there are so-called individual payments that cannot be associated with KTU. We are talking, for example, about additional payment for difficult or harmful working conditions; allowances for work experience, class, length of service, etc. - that is, you are payments that are associated with the position of a citizen or his personality.

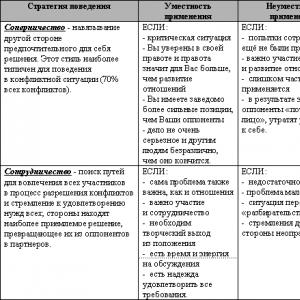

The advantages of using KTU are:

- individualization of employee's work;

- a variant of material punishment for non-fulfillment of their part of the work in the team;

- adequacy in the assessment of the employee's work.

Cons of using KTU:

- if there is a conflict in the team - the possibility of manipulation;

- not always accurate criteria for assessing personnel.

If KTU is used at the enterprise, then it is used constantly, and not once a year or every 3 months. Otherwise, employees have the right to apply for the protection of their rights to the labor inspectorate.

The introduction of KTU in production requires not only proper documentation, but also training of employees, since we are talking about determining labor criteria, mathematical modeling of work, etc. It is necessary to bring to the attention of employees what the size of their wages will depend on, what indicators will be taken into account, that is, to carry out large-scale campaigning and explanatory work.

What formula is used to calculate?

Since the legislator in the Labor Code of the Russian Federation does not explain how the KTU is calculated, the employer has the opportunity to develop his own system for calculating the coefficient in relation to the specifics of his enterprise. Consider one of the variants of the formula.

Labor indicator \u003d basic KTU + K (lowering or increasing criteria).

As a rule, the base KTU is equal to 1 or 100. In other words, if there is no need to apply a lowering or raising criterion, then the premium is paid in the base amount; but if a reduction criterion is used, the required number of points is subtracted. The same is true for escalating criteria.

The employer must approve by a local act not only the calculation formula, but also a list of lowering and raising criteria. This is done, as a rule, in the form of a table and communicated to all employees.

The salary of an employee using KTU will consist of the following parts:

- base salary (tariff rate);

- individual allowances;

The second version of the formula might look like this:

KTU \u003d U / sum Y * number of team members, where

Y - the number of points earned by one employee;

Sum U - the number of general, brigade points.

In the above formula, there is no indication of downgrading and raising criteria. However, they are included in W.

In this case, all data should be summarized in a table. As a rule, the calculation is made by the head of the brigade or an employee of the personnel department. Of course, the figures may change monthly; however, we recommend that you bring the amount of KTU to the employees before the approval of its manager so that the employee can express his claims in case of disagreement before the money is transferred.

The second option for calculating KTU indicators is at the brigade council, where all points are calculated, decreasing and increasing coefficients are considered, etc. This is done to make the calculations transparent. The meeting is recorded in minutes, which is transferred to the head of the organization.

Criteria that lower performance

The criteria that can lower the overall KTU indicator are developed by the employer independently, taking into account the specifics of the work of employees. All criteria are collected in one table and in front of each is the amount of points by which the indicator is reduced.

Here are some examples of downgrading criteria:

- being late for work;

- being late from the lunch break;

- non-fulfillment of daily indicators in percentage terms);

- violation of labor discipline;

- work without protective equipment;

- non-compliance with labor protection requirements;

- marriage in products;

- use of production equipment for other purposes;

- refusal to follow the instructions of the management;

- work on faulty equipment;

- untimely implementation of the instructions of the management, expressed in a decrease in the performance of the brigade.

The list of criteria that lower the KTU indicator can be expanded. However, all criteria should not only be brought to the attention of employees indicating the quantitative data of the reduction, but also explained with specific examples.

It is not allowed to “invent” new criteria without bringing them to the attention of employees in order to manipulate their labor. Otherwise, the guilty person will be held administratively liable under s. 5.27 of the Code of Administrative Offenses and will be forced to pay a fine.

Criteria that boost performance

The list of raising criteria is also developed by the employer. These may include the following:

- increase in the volume of work;

- introduction of new methods of production;

- overtime work;

- mentoring towards new team members;

- non-standard solutions to complex problems;

- fulfilling the duties of an absent member of the team along with their work;

- participation in public life;

- high culture of production;

- strict adherence to safety instructions.

The list of criteria can be expanded. Next to the criterion, a quantitative indicator of the increase should be written.

Thus, the use of KTU at an enterprise in order to calculate additional payments and allowances is applied only if there is an appropriate local act (indication in a collective agreement, labor agreement with an employee). At the same time, all the provisions of the system are brought to the attention of employees, including the calculation formula and indicators that lower / increase the value of KTU.

We will tell you how KTU is deciphered, what the indicators affect. The article contains an algorithm for calculating salaries, taking into account the effectiveness of each employee, samples of useful documents and cheat sheets.

From the article you will learn:

Related materials:

What is KTU in wages

Employees work with different returns, which can be calculated using the labor participation rate. KTU - the degree of contribution of each employee to the benefit of the organization. The base value of the coefficient is 1 or 100.

KTU: transcript

In fact, KTU is a coefficient that is applied to the accruals of employees who, in the billing period:

- completed the assigned tasks;

- adhered to the established requirements for technology, quality, labor protection;

- observe discipline, work instructions;

- performed their duties flawlessly.

Labor efficiency levels in the overall assessment of employees based on labor analysis

Download full table

The basic KTU is reduced or increased depending on the indicators that reflect the personal contribution of the employee to the collective result of labor. Each company determines the individual size of the coefficient of labor participation. The decision is made at the meeting of the brigade and drawn up in the minutes. In the future, daily accounting of parameters is carried out, after which calculations are performed.

KTU (labor participation rate) is usually used for piecework pay. The tariff part is calculated at hourly rates, hours worked. The payment by the coefficient and the premium are paid from the over-tariff part of the payroll. With the help of KTU, they distribute bonuses for labor achievements, a one-time remuneration.

Checklist: how to evaluate the work of a beginner

What affects KTU

|

What reduces KTU (labor participation rate) |

Indicators that increase KTU |

|

|

Which organizations can use KTU (labor participation rate)

KTU in wages can be set in any organization, but the labor participation rate is easier to calculate in production. It is irrational to implement the system in offices, since it is impossible to determine indicators for a particular employee if the type of work is constantly changing. For example, some projects involve different contributions from specialists.

The main condition for the introduction of KTU is the collectivity of labor. The coefficient of labor participation is not determined for individual work. Payroll calculation with KTU is not possible in the following cases:

- damage compensation has been established;

- make additional payments for the night shift, overtime work, including weekends and holidays;

- when accruing bonuses, additional payments for the management of a department or team, bonuses for qualifications;

- allowances have been made.

If there is no teamwork in the organization, there are benefited workers, use other evaluation methods to determine if they are performing well. After analyzing the effectiveness of labor, you can choose the appropriate payment system.

An overview of different assessment methods

Download full table

How to calculate KTU in the brigade

How to calculate the labor participation rate of an employee is decided by the company's specialists, based on the field of activity. At the first stage, the heads of structural divisions offer to fill out a questionnaire in order to calculate the objective parameters and criteria for evaluating employees.

Sample Questionnaire for Managers

Download form

The list of questions should affect all areas of activity, the interests of the organization and employees. To avoid demotivating staff, do not make major changes to the existing pay system, but pay a bonus. At the same time, all employees are required to understand how to calculate KTU by salary. The formula must be viewable.

Spot lazy careerists - host a coaching session

The calculation of KTU is based on the application of a system of established parameters, where each person is assigned points. Previously, the employee is assessed, receives a certain number of points. After which they are summed up, KTU is calculated.

How points are awarded

- The complexity of the work: very hard work - 3 points, moderate work - 2 points, easy - 1 point.

- Load: maximum - 3 points, average - 2 points, minimum - 1 point.

- Working with equipment: 1 point for each type of equipment.

- Maintenance of tools, equipment: 2 points.

- Quality of work: 1 point for control and compliance.

- Responsibility: up to 3 points, from which points are subtracted for violations

Sample score sheet for sales manager

Download form

Calculation of KTU: an example

The team consists of five employees who manufacture parts. For the implementation of the plan, 1000 monetary units are required. The first specialist fulfilled the plan and made the norm. His KTU is 1. The second overfulfilled the plan by a quarter. His KTU is 1.25. The third made the norm, but broke the machine, which led to downtime. His KTU is 0.5. The fourth one repaired the machine, so he got extra points. Its coefficient is 1.6. The fifth specialist was forced to take time off, so he worked less than the others. His KTU is 0.65.

To determine the labor participation rate, the calculation must be performed as follows: 1 + 1.25 + 0.5 + 1.6 + 0.65 \u003d 5. With tariff-free payments, the amount will be distributed as follows: 1000 / 5 \u003d 200. Employees are required to:

- the first - 200 units;

- the second - 200 * 1.25 = 250 units;

- the third - 200 * 0.5 = 100 units;

- the fourth - 200 * 1.6 = 320 units;

- fifth - 200 * 0.65 \u003d 130 units.

It turns out that the calculation of salary according to KTU is carried out according to the formula and depending on the contribution of the employee. It is important to be honest when awarding points and distributing funds. If employees decide that they have incorrectly calculated the indicators, a serious conflict may arise in the company, which will worsen the psychological climate. Motivate them to work harder to get more.

Implement the ROWE strategy: everything for the end result

What to consider when implementing KTU

Calculating the labor participation rate takes time and analysis.

When introducing KTU into the incentive system for workers in production, pay special attention to feedback. Explain to employees the mechanism for calculating wages or bonuses. They must clearly understand what the values of the organization are, for which indicators you can get a bonus. This will partially offset the shortcomings of the system.

Conduct a survey among subordinates: are they involved in the work

Calculation of salaries taking into account the personal contribution of employees causes difficulties. When designing a CTU system, consider many nuances. The system of remuneration and motivation should be transparent, fully understandable and fair. Any employee must understand why he receives less than another specialist with the same education and qualifications. Employees need to explain how the labor participation rate is calculated.